SEZs are popular instruments in developing countries for pursuing export-led growth strategies, for easier integration into the world economy. The main advantage of SEZs can be summarised as promotion of industrialisation and economic growth through sustainable development.

WHAT CONSTITUTES a Special Economic Zone (SEZ) is determined individually by each country. According to the World Bank definition in 2008, a modern day SEZ typically includes “a geographically limited area, usually physically secured (fenced-in); single management or administration; eligibility for benefits based upon physical location within the zone; separate customs area (duty-free benefits) and streamlined procedures.” In an SEZ, business and trade laws relating to export and import are different (read, more liberal) as compared to other parts of the country.

An SEZ is projected as a duty-free area for the purpose of trade, operations, duty, and tariffs. This demarcated zone is considered to be a place outside the country’s national borders for all tax purposes. Thus, SEZs are like a separate island within the territory of a particular country. SEZs are located within a country’s national borders, and their aims include increased trade balance, employment, increased investment, job creation and effective administration. To encourage businesses to set up in the zone, financial policies are introduced. These policies typically encompass investing, taxation, trading, quotas, customs and labour regulations. Additionally, companies may be offered tax holidays, where upon establishing themselves in a zone, they are granted a period of lower taxation.

Most countries (including India) have specific laws for their SEZs. As per law, SEZ units are deemed to be outside the customs territory of the host country. Goods and services coming into SEZs from the Domestic Tariff Area (DTA) are treated as exports from that country and goods and services rendered from the SEZ to the DTA are treated as imports into that country. Within SEZs, units may be set-up for the manufacture of goods and other activities including processing, assembling, trading, repairing, reconditioning, etc.

The creation of SEZs by the host country may be motivated by the desire to attract Foreign Direct Investment (FDI). The benefits a company gains by being in a Special Economic Zone may mean that it can produce and trade goods at a lower price, aimed at being globally competitive.

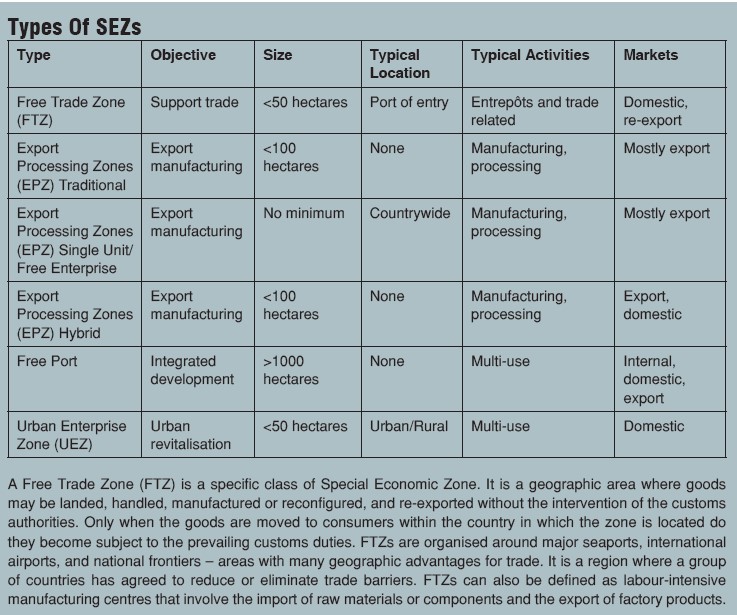

Since Special Economic Zones cover a broad range of more specific zone types, the World Bank created a table to clarify distinctions between types of SEZs. These include Free Trade Zones (FTZ), Export Processing Zones (EPZ), Free Zones (FZ) / Free Economic Zones (FEZ), Industrial Estates (IE), Free Ports and Urban Enterprise Zones (UEZ) among others.

opening of China in 1979 by Deng Xiaoping, was the Shenzhen Special Economic Zone, which encouraged foreign investment and simultaneously accelerated industrialisation in this region. These zones attracted investment from multinational corporations. Following this example, SEZs have been established in several countries including India, Pakistan, Poland, Russia, Kazakhstan and the Philippines.

Several countries in the West Asia, North Africa and the Middle East were early adopters of free zones. Jordan, Israel, Syria, Iran, and Egypt, for example, established governmentrun zones in the 1960s and 1970s.

The majority of zones in the Middle East and North Africa region are Free Trade Zones, aimed at facilitating trade with their host countries. Though many of these zones permit manufacturing, trading and associated activities (for instance, packaging and repackaging, breakbulk) remain predominant. With a handful of exceptions, the economic contribution of zones in the Middle East has been negligible compared to zone programmes in the Far East and Latin America, largely due to their traditional focus on trading activities rather than manufacturing. The notable exceptions to this are zones in Egypt and Jordan, which have developed a manufacturing focus. Enterprises in the Qualified Industrial Zones (QIZs) in Jordan, for example, are engaged in apparel assembly operations for the US market.

The government-developed Jebel Ali Free Zone in Dubai, a major regional distribution and logistics hub, has become an important development model in the region. Its success has spawned an increasing number of similar zone developments in the Gulf, not just within the other Emirates, but also in Oman and Bahrain. Dubai has also taken the lead in developing new, specialised zones, including both Internet City and Media City, which promote exports in IT and media-related services. A $3.3 billion large-scale offshore financial services zone and commodities market is being developed on Saadiyat Island, AbuDhabi.

SEZs In India

The Special Economic Zone (SEZ) policy in India first came into inception on April 1, 2000. The prime objective was to enhance foreign investment and provide an internationally competitive and hassle free environment for exports. The idea was to promote exports from the country and realising the need that level playing field must be made available to the domestic enterprises and manufacturers to be competitive globally.

SEZs were introduced to India in 2000, following the already successful SEZ model used in China. Prior to their introduction, India relied on Export Processing Zones (EPZs) which failed to make an impact on foreign investors. By 2005, all EPZs had been converted to SEZs. As of 2017, there are 221 SEZs in operation, with a further 194 approved for 2018. For developers to establish an SEZ in India, applications can be made to the Indian Board of Approval. Companies, partner firms, and individuals may also apply by completing Form-A which is available on the Department of Commerce’s website. There are four types of SEZs in India, which are categorised according to size: Multi-sector (1,000+ hectares); Sector-specific (100+ hectares); Free Trade & Warehousing Zone (FTWZ) (40+ hectares); and Tech, handicraft, non-conventional energy, gems & jewellery (10+ hectares).

INCENTIVES & FACILITIES

The incentives and facilities available to SEZ developers include:

- Exemption from customs/excise duties for development of SEZs for authorised operations approved by the BOA.

- Income Tax exemption on income derived from the business of development of the SEZ in a block of 10 years in 15 years under Section 80-IAB of the Income Tax Act.

- Exemption from minimum alternate tax under Section 115 JB of the Income Tax Act.

- Exemption from dividend distribution tax under Section 115O of the Income Tax Act.

- Exemption from Central Sales Tax (CST).

- Exemption from Service Tax (Section 7, 26 and Second Schedule of the SEZ Act).

There were about 143 SEZs (as of June 2012) operating throughout India, by February 2016 this had risen to 187. 634 SEZs have been approved for implementation by the Government of India (as of June 2012).