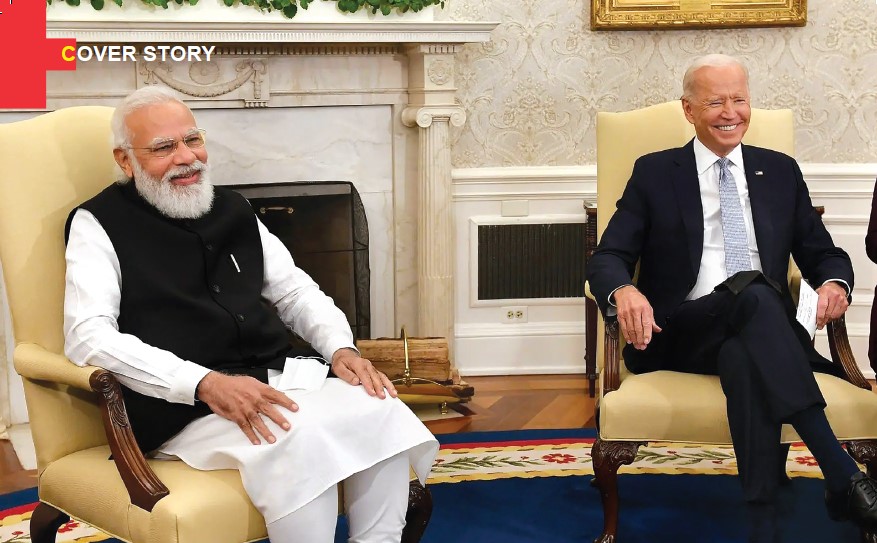

The recent meeting between the Indian Prime Minister Narendra Modi and US President Joe Biden evoked a lot of interest for watchers in the diplomatic sphere given the fact that Narendra Modi had been seen openly supporting the Republican Party’s incumbent Presidential candidate Donald Trump. It was indeed a pleasant surprise that Joe Biden put US-India relations ahead and lead the talks to build on existing relations and to strengthen US-India trade relations which were going down hill under the previous regime. N Chandra Shekar reports on some of the key takeaways from this visit…

THE INDIA-US TRADE RELATIONS have been much in the storm in the recent years. India’s trade surplus with the US had become a bone of contention for the erstwhile President Trump. Both India and US accused each other of unfair trade practices and were among the most active litigants at the World Trade Organisation. Not withstanding the bonhomie between President Trump and Prime Minister Narendra Modi both nations have not been able to arrive at common ground on the myriad of trade issues that plague the two. When US President Joe Biden and Indian Prime Minister Narendra Modi met in Washington last month for the first time in Biden’s presidency, their talks on trade were limited and only briefly referenced in a joint statement. This cursory treatment suggests trade has been relegated to secondary importance. Instead, this should be an inflection point for growing the US-India trade relationship, ideally to eventually match the scale and importance of their strategic relationship.

While US President Joe Biden has begin to pursue his restorationist agenda on “rescuing US foreign policy” after Donald Trump’s presidency, his agenda on USIndia ties will differ. While US ties with partners across the Atlantic for instance, will warrant Biden’s mitigation efforts, the agenda with India will pertain to furthering Trump’s record. However, the domain of US-India trade, which peaked at $146.1 billion in 2019, will cause some trepidation owing to frictions witnessed in the Trump years. Given Trump’s focus on exacting “fair and reciprocal” trading arrangements, his administration vocalised apprehensions against nations that had amassed trade surpluses over the US. Even though India’s trade surplus is less than a tenth of the US-China trade imbalance, New Delhi did not escape Trump’s action against nations “cheating” the US. It all started with the imposition of import tariffs on steel and aluminium from twelve countries including India. This later developed into a full-fledged bilateral trade war with China. The US also rolled back export incentives for Indian Exporters under its Generalised System of Preferences (GSP) programme affecting India’s exports worth USD 6billion dollars to US under the scheme. In retaliation, India imposed high customs duties on twenty-eight US products, including almonds. The US administration has also started targeting nations who are having a trade surplus with the US including India. With either side not giving in a whole lot of issues have become a bone of contention.

For India one of the key issues has been the withdrawal of the concessions offered to Indian Exporters under the US Generalised System of Preferences which allowed tariff free import of selected commodities (around 3500) from 129 countries for failure to provide equitable and reasonable market access. GSP provides nonreciprocal, duty-free tariff treatment to certain products imported from qualifying developing countries. India has given a representation with the US trade officials for the extension of the GSP.

One of the important issues for the US is its export of farm and poultry products. Sanitary and phytosanitary (SPS) barriers in India limit U.S. agricultural exports. The United States has been raising questions on the scientific and risk-based justifications of such barriers. India had banned chicken imports from US citing avian infuenza risks. But in 2015, the US obtained a favourable verdict from the WTO’s DSB. The WTO ruled that India’s measure was disproportionate to the threat and constituted a non-tariff barrier. In the context of the WTO verdict, the government made changes in the health certification requirement for imported poultry items from the US.

Further the US accused India that it is under reporting subsidies given under Minimum Support Price (MSP) This is the first ever Committee on Agriculture notification by a country under The Agreement on Agriculture (AoA). The US also raised obstructions on India’s food security programme at the Buenos Aires Ministerial Conference (MC). Because of this US stand, WTO failed to reach consensus to provide a permanent solution to the Public Stock Holding of Food Grains on food security ground. As a reply, India and China asked the developed world to reduce their exorbitant levels of farm subsidies. At the Buenos Aires Ministerial Conference of the WTO, the US argued that countries like China and India doesn’t qualify for the Special and Differential Treatment benefits given for developing countries. India strongly objected to the US version

Bilateral tensions have increased over each side’s tariff policies. India has relatively high average tariff rates. The US increased tariff on Steel and Aluminium imports from twelve countries including India. The Indian government approached the WTO’s Dispute Settlement Body against the US move. The government’s stand is that use of the tariff against selected countries is a violation of the Most Favoured Nation clause of the WTO.

As a response to the US tariff on Steel and Aluminium, Commerce Ministry on June 20th notified tariff hike on twenty-nine US products, including almonds, apples and phosphoric acid etc. (worth $10 bn) in retaliation to the steel and aluminium tariff hikes by the US. At the same time, India reduced tariff on selected imports from India including that on few categories of bikes to defuse the trade tension. Perhaps the most devastating step by the Trump administration has been to put a curb on H1 B visas. A key issue for India is U.S. temporary visa policies, which affect Indian nationals working in the United States. India is challenging U.S. fees for worker visas in the WTO and monitoring potential U.S. action to revise the H-1B (specialized worker) visa program. Under its visa restrictions policies, the number of visas to be issued under H1B was reduced; Visa fees were doubled for H1B; Visa eligibility in terms of annual income raised; thereby reducing opportunities for India’s skilled Labour. It also stated that H1 B visas will be issued for single projects. After the completion of the project, the person would have to return without looking for any other job in the US. Further the qualification requirement was also changed such that a two-year degree/diploma was invalidated, and a four-year degree qualification was necessitated for the issue of H1B visas. All these steps hurting the operations of Indian IT firms in the US.

The United States continues to press India to address its “forced” localization practices, such as incountry data storage, domestic content, and domestic testing requirements—viewed by the United States as presenting barriers to trade with India. Adding to U.S. concerns are India’s new restrictive localization rules for certain financial data flows, which affect companies such as Visa and MasterCard. At the same time, India has moved to ease some local sourcing rules for singlebrand retailers, which would affect companies such as Apple. The US had taken India to the WTO’s Dispute Settlement Body against the limited

local sourcing requirement under the National Solar Mission and secured a favourable verdict. Later, the US alleged that India is not following the verdict and sought WTO’s permission for taking retaliatory measures.

India is continuously listed under the priority watch list in the US Intellectual Property documents that is prepared under the infamous Special 301 law. India is placed along with China and ten other countries. According to the US, countries in the list will be the subject of particularly intense bilateral engagement in future.

A surprising development is US policy on currency management. Here, the US included India under currency practices and macroeconomic policies monitoring list along with China, South Korea, Japan etc.

The US also raised objections at the WTO to the export incentives given by India arguing that India doesn’t qualify to provide export incentives allowable for low income developing countries. It stated that India’s GNI per capita income crossed $1000 for three consecutive years and hence the country is not eligible to provide export subsidies. The US objected to five export incentives given by India.

The United States and India trade on WTO terms, as they do not have a bilateral FTA. The United States and India often have opposing stances in the WTO, whose future direction is unclear amid debate over institutional reforms and future negotiations. India objected to the US stand of vetoing the appointment of judges to the WTO’s Dispute Settlement Body. India demanded that US should not block the running of the DSB and this is needed to protect the multilateralism-based governance of global trade. India and 37 other countries made a formal proposal for the appointment of the judges that has been blocked by the US. The US demanded changes in the functioning of the Appellate Body and demanded an amendment to the existing rule which allows judges to continue cases assigned to them before their terms ended.

Currently the United States and India are holding negotiations to address bilateral trade frictions. They reportedly are discussing a deal for U.S. reinstatement of GSP for India in exchange for certain market access commitments from India. Both are understood to have resolved most of the important trade issues, thus paving the way for an ‘initial trade package’ wherein the two countries are looking for an equitable market access.

However it would be unrealistic to hope that the United States and India might suddenly work together multilaterally on trade, which makes the bilateral trade relationship even more essential for resolving specific trade problems and generating productive dialogue going forward. Yes, the value of US-India bilateral trade and cross-border investments continues to grow—but this part of the relationship between the US and India remains unstable. It’s threatened by a range of risks, including regulatory trends that restrict economic integration and the threat of economic sanctions over India’s defense trade with Russia.

To shift toward stability, Washington and New Delhi will need to articulate a joint vision for a deeper, broader, and more integrated economic relationship