Dr. Pranav Kumar, IPS, Additional CP (II), Kolkata Police

The internet has made life significantly easier by allowing us to shop, bank, communicate, and conduct business online. However, this convenience has also increased the risk of cyber fraud, where criminals employ various methods to deceive people and steal money or sensitive information. Cybercriminals exploit technology and human error to carry out these activities. Awareness and prevention are essential to staying safe online. While law enforcement agencies, such as Kolkata Police, are actively working to combat cyber fraud, public participation and awareness are crucial in minimizing risks.

Understanding Cyber Fraud

Cyber fraud encompasses any criminal activity that is executed using a computer, smartphone, or the internet. Anyone can be a victim—students, professionals, senior citizens, and business owners alike. Understanding the different types of cyber fraud is the first step in preventing them. Some of the most common types include:

Phishing Attacks: Fraudsters send fake emails, messages, or calls pretending to be from banks, government agencies, or trusted companies in order to steal personal details such as passwords, ATM PINs, and OTPs.

Online Financial Frauds: Fake e-commerce websites, UPI scams, and fraudulent investment schemes trick individuals into making payments without delivering goods or returns. Many people worldwide have lost money to investment fraud by investing in fake stocks suggested by scammers. Recently, there has been a rise in online hotel booking fraud, where unsuspecting customers are deceived by fraudsters through sham websites that offer extremely low hotel rates at various tourist destinations.

Identity Theft: Criminals misuse stolen personal data to commit financial fraud, apply for loans in someone else’s name, or create fake social media profiles to mislead others.

Ransomware Attacks: Hackers install malicious software that locks important files and demand payment to unlock them. Increasingly, criminals are asking for ransom payments in cryptocurrency.

Social Media Frauds: Fraudsters create fake profiles to offer phony job opportunities or use emotional manipulation in online relationships to trick victims into transferring money. Numerous instances of WhatsApp account hacking have been reported, where cybercriminals gained control of accounts after victims unknowingly shared their OTPs (One-Time Passwords).

SIM Swap Fraud: Scammers obtain a duplicate SIM card of a victim, allowing them to access mobile banking and steal funds from the victim’s accounts.

Online Loan Scams: Fraudulent loan providers offer quick loans and request processing fees or personal information, which is later misused.

QR Code Scams: Scammers trick individuals into scanning QR codes that lead to unauthorised withdrawals or deductions from their bank accounts.

Digital Arrest: This emerging cybercrime involves scammers extorting money or sensitive information by threatening victims with legal action. In cases investigated by the Kolkata Police, scammers have misused identity documents or falsely accused victims of having narcotics sent in their name. Many people have lost significant amounts of money in these schemes. The Kolkata Police have successfully made several arrests related to this type of fraud.

Legal Provisions Against Cyber Crimes

Cyber fraud is punishable under various sections of the Information Technology Act, 2000, and the Bharatiya Nyaya Sanhita, 2023, which has replaced the Indian Penal Code.

Best Practices to Prevent Cyber Fraud

To enhance your cybersecurity and protect against fraud, follow these essential practices:

Never Share OTPs or Bank Details: Remember that banks and government agencies will never ask for your OTPs, PINs, or passwords. Always verify any requests before sharing any personal information.

Use Strong Passwords: Create passwords that combine letters, numbers, and symbols. Change your passwords regularly and avoid reusing the same password across multiple accounts.

Enable Two-Factor Authentication (2FA): Turn on 2FA for your banking, email, and social media accounts to add an extra layer of security.

Verify Unknown Links: Avoid clicking on suspicious links in emails, SMS, or WhatsApp messages, as these may lead to phishing websites.

Use Secure Websites: Before entering payment information, ensure the website URL begins with ‘https://’ and is from a trusted source.

Avoid Public Wi-Fi for Transactions: Public networks can be vulnerable to hacking. Use a VPN or mobile data when conducting financial transactions.

Check Financial Statements Regularly: Monitor your bank account and credit card statements frequently to catch any unauthorised transactions promptly.

Do Not Download Unknown Apps: Fraudsters may create fake apps to collect your data. Always download applications from official sources, such as Google Play or the Apple App Store.

Be Cautious with QR Codes: Always verify the source of a QR code before scanning it. Avoid scanning if someone requests payment through QR codes without providing an explanation.

Educate Family Members: Cybercriminals often target senior citizens and teenagers. Ensure that you educate them about online safety to help protect against potential scams.

Steps to Take If You Are a Victim of Cyber Fraud

If you suspect that you have been scammed, take immediate action to minimise damage.

Fraudsters often act quickly, withdrawing funds, transferring them across international borders, or converting them into cryptocurrency to evade detection. The sooner cyber fraud is reported, the higher the chances of recovering the lost funds. Here are the essential steps victims of cyber fraud can take:

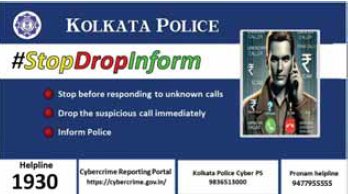

Report the Fraud: Call the national cybercrime helpline at 1930 or visit www.cybercrime.gov.in to file a complaint. You can also contact the Kolkata Police Cyber Police Station at +91-9836513000.

Inform Your Bank: If your bank account is affected, notify your bank immediately to freeze transactions and prevent further losses.

Change Passwords: If your online accounts have been compromised, reset your passwords right away.

Keep Evidence: Save messages, transaction details, emails, and screenshots as proof for the investigation.

Inform the Cyber Crime Cell or Nearest Police Station: Registering a complaint and allowing an investigation can assist in recovering funds and apprehending the culprit.

Kolkata Police’s Role in Fighting Cyber Crimes

Kolkata Police actively works to prevent and investigate cyber fraud through various initiatives:

Cyber Awareness Programmes: Organising workshops, campaigns, and social media drives to educate citizens about online fraud. Under the CyBuzz programme, a bus tours the city providing educational materials on cyber safety.

Specialised Cyber Crime Units: A dedicated cybercrime police team investigates fraud cases and tracks down criminals. Cyber fraud cases are also handled by respective police stations.

Collaboration with Banks and Digital Platforms: Working with financial institutions to track and freeze fraudulent transactions.

Training Police Officers: Enhancing officers’ skills to tackle evolving cyber threats through specialised training programmes.

Stop, Drop, and Inform Campaign

The Kolkata Police has launched the Stop, Drop, and Inform campaign to help citizens protect themselves from telecaller scams and other cyber frauds. The Kolkata Police has initiated the “Stop, Drop, and Inform” campaign to assist citizens in safeguarding themselves against telecaller scams and other forms of cyber fraud.

The campaign focuses on three key areas: (i) Improving police response, detection, and recovery in cases of cyber fraud, (ii) Raising awareness among the public, and (iii) Providing special protection for the elderly.

The campaign suggests the following key

steps for citizens:

STOP: Before responding to unknown calls or sharing personal information, such as bank details, ATM PINs, OTPs, or passwords, think twice.

DROP: If you receive suspicious calls or see emails/messages requesting personal details or money, ignore and delete them.

INFORM: If you suspect fraud or believe you have been a victim, contact the police or the cyber crime helpline immediately.

This straightforward approach can help prevent many instances of cyber fraud and minimise financial losses for individuals. Campaigns targeting the elderly have been initiated through the flagship project, Pronam, along with regular programmes organised throughout the city. Additionally, regular cyber awareness materials are being disseminated via the Kolkata Police Twitter handle @KolkataPolice and Facebook page www.facebook.com/kolkatapoliceforce. Kolkata Police will soon be launching programmes on FM radio and podcasts to further the cause of cyber awareness.

Conclusion

Cyber fraud is a growing concern that requires awareness and active participation from everyone. By following basic online safety measures, staying alert to suspicious activities, and promptly reporting cyber fraud, individuals and businesses can protect themselves from financial losses. Kolkata Police remains committed to tackling cybercrime, but public cooperation is essential. Remember the “Stop, Drop, and Inform” approach to safeguard yourself and your loved ones.